Why Crypto Gaming Is Not The Future

Featuring ponzinomics, the Mundell-Fleming Trilemma and more

This week, Take Two Interactive announced that they were acquiring Zynga. All analyst focus is now on how accretive this acquisition can potentially be given the eye watering premium Take Two paid, and the stock took a massive beating on the announcement. On a somewhat interesting note, Zynga also seems to be trying to embrace Web3 with NFT mobile games (I have no idea how this is going to actually work).

So that is what’s happening in the real gaming market, but meanwhile in the crypto market there seems to be a huge craze taking over which is the advent of blockchain gaming. “Metaverse” games are raising VC funds at ridiculous valuations as people across the board are betting that this is the future of gaming. I’m going to explain why this is not the case. Game economies are something which I’ve spent a lot of time with, I used to do game design stuff on Roblox, so seeing all this hype pop up really made me want to figure out what was going on here.

To really get into this, we need to look at a few things:

What Is Crypto Gaming?

What Drives P2E/Crypto Games Currently?

The Fatal Economic Flaw Inherent To Crypto Gaming

Lessons From Roblox

What Is Crypto Gaming?

Crypto gaming is a relatively new invention in the crypto (web3.0 if you like the marketing rebrand) space. Supporters call it the next iteration of crypto adoption, where they expand the long-held notion in crypto of “self sovereignty” into the realm of gaming too, where all their accumulated in-game currencies and special items (represented as NFTs) sit in their crypto wallets, free for them to monetise at any point by selling them on the open market. The phenomenon of being able to earn in-game currency (similiar to how you can earn small amount of in-game currency in games like Fortnite) but with the ability to sell it for real fiat currency has earned the genre the “Play to Earn” (or P2E) label.

What Drives P2E Games Currently?

Well, first, why do people play games? Because they enjoy it, or if we’re talking in economic terms, they gain utility from it. Kids play Roblox because they want to have fun playing with their customised avatars in user-generated games. Teenagers play Call of Duty Warzone because it’s an inherently *fun* game. The games I’ve just mentioned are free to play, but other very popular games like Grand Theft Auto V, Fifa 21 etc etc do cost money.

But P2E turns this idea on its head completely. Crypto gamers aren’t playing these games because they’re fun. In fact, all these games are very underdeveloped and frankly very boring. The reason why players play P2E games is in the damn name: to earn

It’s not play to have fun like games have been for eternity, it’s play to make money. I’m guessing you’re raising your eyebrows right now.

How it works is pretty simple, and I’ll walk you through the very simplified user flow of the most hyped up and popular blockchain game, Axie Infinity (basically dollar store Pokemon), to explain this.

Here’s a diagram which shows an overview of the Axie economy:

(Credit to AxiePulse)

So to breed Axies, one needs to buy SLP + AXS (the governance token for Axie). Therefore, the demand for SLP (what keeps the price propped up) is a function of breeding activity. But that’s not all, there’s also pure speculative demand from degens on CEXs. It is important to note that currently the quantity of token inflation far exceeds the amount of SLP being destroyed through the breeding process.

The speculative market for SLP, although beneficial in the initial stages to help increase the SLP price, will also accelerate the further downfall of SLP when the market starts to see more players trying to exit to realise their “earnings” and less players willing to enter the game. Reflexivity is a real thing, and it’s going to particularly sting the crypto gaming market for sure.

This tweet from Zhu Su is true, GameFi (another name for crypto gaming) is where participants are punting purely for degen entertainment purposes:

Now, back to the actual Axie Inifnity game, the only purpose of “breeding” really in this play to earn game is to sell these Axies to new players who want to join the game to earn tokens and breed Axies to then again sell to new players. SLP is earnt by the Axie players for the purpose of either 1) breeding Axies so they can sell the newly formed Axies to new players entering the game or 2) selling SLP to players who want to quickly acquire SLP a.s.a.p to breed Axies to sell to new players entering the game instead of waiting to earn SLP from playing the game

Every single player of Axie Infinity is hoping that they can exit for more than they paid to enter the game. That’s what “earning” is. If they don’t make more money than they put in, it’s no longer play to earn, it’s play to lose.

Where have we heard a similiar business model before? If it looks like a duck, walks like a duck, and quacks like a duck, it’s probably a duck. Yeah… So how does the developer make money here? Sky Mavis, the developer just takes a % fee from sales in the NFT marketplace. It seems cruel that people in the Phillipines are being told that playing games is their route to financial freedom. Dragging underprivileged people into “play to earn” games, making them borrow from “guilds” because they can’t afford to front the costs of entering the game themselves in exchange for a large share their “earnings”, which all come from selling their NFTs and SLP tokens to new players who want to do the exact same thing, is not a pathway to financial freedom at all.

The easiest way to think about this is: if instead of handing out their own SLP tokens, Axie Infinity paid users USDC to play the game, would it work? The answer is no, because the Axie Infinity Treasury would run out of USDC very quickly. This whole thing is a game of token inflation relying on suckers to keep on coming in. That’s it.

The Fatal Economic Flaws Inherent To Crypto Gaming

For a second, scrap the pyramid concept. This is the part where I think things get really interesting. There’s a fatal flaw inherent to the concept of blockchain gaming which renders the whole thing moot from inception, even before we get into the “It’s a ******* pyramid scheme!” argument.

Bear with me whilst I walk you through this.

Instead of selling in-game items directly for fiat currency, traditional game developers tend to sell in-game items for their own in-game currency, which itself has its price fixed to the dollar. Game developers fix the in-game currency price to USD because they want to be able to monetise their game simply, and a lot of their expenses are denominated in USD! A floating currency means that suddenly a crucial factor which drives the in-game economy becomes uncontrollable/unpredictable, which is not what a developer wants. This is why games like Fortnite, Roblox, GTA V, all have their in-game currencies pegged to the dollar.

Developers also have to make sure they “drip” a small amount of their own in-game currency to the users to incentivise them to continue playing the game, in the hope that they are more likely buy in-game currency. To have full control over the supply of the in-game currency, they have to have monetary autonomy. (In the case of crypto games too, they will have to have monetary autonomy to effectively design the “tokenomics” of their currency)

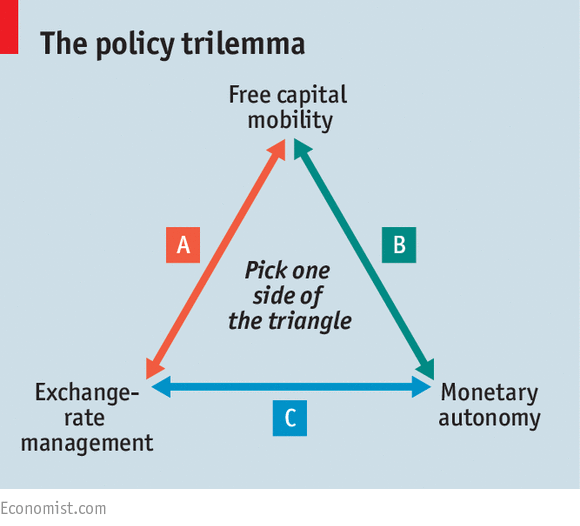

So, I explained all this in-game economy design stuff to an ex FX and interest rate derivatives trader with decades of experience a couple of weeks ago, talking about how Roblox has to implement capital controls to the extent that they make it almost impossible to buy Robux on the secondary market because their entire business model relies on them being the only supplier Robux for fiat currency and they have to keep the price stable because it’s good for both UX and their business. He then pointed out to me that my point could be summarised under the Mundell-Fleming Trilemma, and NOW THIS trilemma is what exposes the fundamental economic flaw of crypto gaming. It was at this point that everything came together.

So, in a given traditional game economy, as for reasons I’ve explained above, the developer chooses the path of a fixed exchange rate and monetary autonomy. That means that under this arrangement, which is the arrangement for every successful game with an in-game currency mechanism, there has to be almost NO capital mobility. This is Economics 101. In practice, this means that after acquiring in-game currency for USD, users can only spend the in-game currency on the game, they can’t sell it to someone else on the open market. Unlike Chinese capital controls which are notoriously leaky, traditional game economy capital controls are extremely close to perfect (although there are very illiquid underground markets for game account details, these markets are not enough to pose a threat to the monetary policy autonomy + fixed exchange rate policies of the game developers since users actually have to give up their account entirely, they can’t keep their account and sell off unwanted currency. It’s also against T+Cs so users can face getting banned if caught).

Here’s a simplified diagram I made to help you visualise this better:

However, as I’m sure you know, the fundamental tenet of crypto gaming is FREE capital mobility. That’s what having an in-game currency which can be bought and sold on the secondary market entails. Developers also need to have monetary autonomy for the purposes of designing the game’s incentive structures through in-game currency. This finally results in a game with volatile and fluctuating prices based on the exchange rate between the in-game currency and fiat currency.

This is absolutely not an attractive policy position in a game economy for the development of AAA games from a developer’s perspective since it introduces a ton of unpredictability around the game economy, and from the gamer’s perspective constantly fluctuating cryptocurrency prices to play a game simply isn’t good UX (referring back to the Axie economy diagram, a certain amount of SLP + AXS is required to breed Axies, but the prices of SLP + AXS are changing constantly, so the price you pay in USD terms for breeding Axies is actually constantly fluctuating based on the highly volatile crypto markets). The fact is that a stable in-game economic environment (price stability!) is key for game developers and gamers alike, hence why the optimal position side of the triangle is C . Crypto games, logically speaking, are restricted to having to choose B , a horrible situation which is quite really a non-starter in terms of game design principles… C has become ubiquitous across the entire industry precisely because capital controls are the only way a game developer can make money when there is an in-game currency, since by restricting others selling currency on the secondary market, the developer can keep a monopoly on the issuance of the currency, and so it leaves them in the position that every time a player wants to buy the currency they go to the developer directly and pay them real USD in exchange for new in-game currency. It makes the monetisation of the game *sustainable*.

There is a reason why game developers make so much effort to restrict secondary market trading of their currencies). The flawed P2E model inevitably means that developers have to resort to alternative methods to monetise the game, like making the purchase of a certain amount of NFTs compulsory to even start playing the game, and then taking % fee of every NFT transaction. This model is only sustainable as long as there are more and more players entering the game to make money by purchasing the NFTs and then grind out many hours, which they will only do if they can sell all their NFTs and earned tokens to someone else who wants to do the same thing. This really convolutes the basic model of a game for all parties involved.

Time for the other critical economic flaw with crypto gaming: as I alluded to before, if the narrative is really about compensating players for their time, then why aren’t P2E games paying all their players in stablecoins for their time? It’s very simple. You may find it easier to just simplify this into a basic macroeconomic scenario. Just like the south of Italy is dependent on tourists coming in and spending money (tourism is an export of course), a game economy is dependent on gamers spending money on goods and services in the game.

If they paid all the players in USDC, what these developers have on their hands is basically have is a massive balance of payments problem. They are importing vast amounts of services (paying players to play their games) and exporting very little (they are exporting a service which takes a small % fee of the NFT transactions). They have a gaping current account deficit. If they were paying in stablecoins or any other currency for that matter which they have no control over, they would have to find ways of financing that deficit through constant fundraising. But they know that’s not a tenable solution, they know that they’d drain their treasury real fast. So the only possible solution to this problem is that they create own tokens to pay for these imports, and alas you have rampant token inflation to keep attracting players into the economy and to keep the circus continuing.

For P2E to be sustainable, the game developer has to earn more from each player than they are paying them to play. It’s really that simple. There is no free lunch in this world. There is a specific reason that they pay in their own tokens, and not through something like stablecoins. The game would collapse much faster…

To summarise, play-to-earn games are cornered into having a totally free floating exchange rate, autonomous monetary policy and no capital controls by the very constraints of being games on a decentralised blockchain (you can’t have capital controls on a permissionless blockchain, and when designing a game you need to have control over the token supply for things like token incentives etc).

The play to earn model inevitably means that the game economies have something akin to massive current account deficits which they have to resort to financing through token inflation because they simply wouldn’t be able to attract enough financing to cover these deficits in USDC. The game would be *heavily* loss making if they didn’t create their own tokens out of thin air ; it doesn’t cost the developer anything to keep printing tokens, but it does cost them when they start paying in USDC.

Lessons From Roblox

Roblox is a great example of how to design a game economy (game economies rather, Robux powers all games in the Roblox ecosystem). Not just from a currency perspective (issuing and redeeming Robux at massive spreads, 30% transaction tax to withdraw R$ from circulation, requiring adverts to be paid for in R$ etc). Crypto gaming bros think they’re onto something new here, but the truth is, Roblox has tried and implemented these concepts before, to various levels of failure and success.

Play To Earn Drives Bad Platform Mechanics

What? Roblox had Play To Earn? Yes, that’s right. Roblox used to have a dual currency circulation system for 9 years. Robux was the hard currency and Tix was the “free” currency that was rewarded for participation. Tix could be used for user ads , something which now costs real money with Robux, so they were effectively giving out free utility. But it came with a problem, there was a lot of botting of alt accounts which slowed down the platform, and people were just logging in for Tix, not because they wanted to play the game.

The bigger problem with Tix which Roblox failed to mention in their explanation for why they were getting rid of Tix was that there was a huge live trading market where users could buy and sell Robux and Tix, and it was basically a speculative market where lots of users made Robux profits by speculating on the prices. The botting also meant that accounts were piling up Tix and converting them to Robux, effectively giving them free “money”. Given all this, Tix was cancelled in 2016. Play to earn will incentivise people making multiple accounts and create an inauthentic user experience, ultimately harming the game in the long-run. Roblox realised this years ago and moved to fix it.

Conclusion

Narratives can be moulded, but unfortunately crypto gaming evangelists will not be able to change basic economics. The fact that the problem with the Mundell-Fleming trilemma and how crypto games fall on the wrong side of them from a pure game design perspective which ultimately prevent large developers from creating AAA games with open economies as well as ruining user experience is totally ignored by VCs who are funnelling absurd amounts of money into these projects makes me question if they actually believe in the narrative they’re pushing, or if they’re simply investing in token pre-sales and planning on dumping on unwitting retail bagholders.

For the record, I’m not a crypto hater or anything, things like being able to send dollars cross-border without stringent KYC/AML is pretty cool, and that’s happening a lot in emerging markets. I’ve personally used a lot of DeFi protocols on Solana and it’s actually pretty fun, all I’m against is false narratives being peddled and dumping what are effectively unregistered securities on clueless retail investors. There’s also clear use cases for blockchain technology in finance, JPM is building repo markets using distributed ledger technology with basically instant settlement and interest being calculated up to the minute (albeit this is a much more centralised process, it’s a blockchain within a regulated walled garden, unlike say Ethereum or Solana which are open).

However, I just don’t see the application of decentralised blockchains in gaming, there isn’t a need. Putting games on the blockchain will just result in really slow servers as everything would constantly have to be verified by a decentralised database. No one gamer has ever said: “I don’t trust Rockstar to store my data correctly which is why I won’t buy GTA V”. Building games for the sole purpose of “play to earn” or “play to own” means that players are no longer playing games for enjoyment, but rather the hope that they can monetise their holdings. Inevitably, this means that the quality of game experience will drop, as developers focus solely on how to turn every single aspect of a game into an NFT which can be traded. Collectible trading should be complementary, like in Roblox or Counter-Strike , it should not be the whole purpose of a game. You might as well scrap the game altogether, and just focus on making NFT collections like Bored Apes or Cryptopunks. Recreating games to have a similiar culture will not work out.

I’m open to any and all feedback on this, specifically from game designers working on crypto games. But I’m structurally bearish on P2E, GameFi, whatever you want to call it for the above reasons.

Also, given that crypto mining is the very reason gamers are getting extorted on their GPUs, I doubt many are going to be enthusiastic at something that will contribute to that squeeze even further. All one has to see is the huge backlash Ubisoft recently faced through trying to introduce NFTs. Analysts attribute it to the fact that gamers are worried about climate change (lol, that’s not why gamers hate NFTs). It’s actually the fact that gamers see NFTs as ruining the in-game experience, as it means that people who have nothing to do with the game will be buying NFTs from game developers, hoping to flip them to other speculators. Hence developer incentives will then be skewed towards ensuring expanding supply of NFTs to speculators, which might not even be very useful inside the game. Games are designed for people to have intrinsic fun, they’re not optimised for speculators to try and make as much money as possible.

Update: 16/01/2022

In response to a few DMs, I just want to make it clear that this is a critique of crypto gaming as it is, specifically the Play to Earn model which is being touted as the future of gaming. The reason I say I don’t think crypto gaming is the future is the path this “web3 gaming” group is going down. Just look around you, listen to the new Bankless Podcast on crypto gaming and you’ll see what I mean. However, there is a way that crypto can be incorporated into games in a sustainable fashion (somewhat) which is basically a governance token ICO to raise funds from the community to build out a product, have a standard game product which isn’t play to earn but either a) free to play (with in-game purchase monetisation like selling weapon upgrades for USDC) or b) pay to play (Pay 50 USDC to access a game like you would do with FIFA)

Making a normal game and then using all revenues from in-game sales to do buybacks of the token as a way to return capital to early backers, as well as voting on key game updates/protocol decisions is basically the only way I see this working, and that would be actually quite interesting. Imagine you paid to Call of Duty Black Ops, but the earnings go to a DAO instead of Activision. You could easily have more community engagement via the governance token, and could end up with more optimal outcomes. Having the governance token could also allow for holders to get a discount on in-game purchases, giving it some sort of real utility similiar to FTT or BNB (discounts on CEX trading fees). If Activision brought out, say, $BLIZZ which gives users discounts on in-game purchases, it would definitely have utility and not be a total shitcoin like SLP which is just a coin to continue Axie’s scheme. Unfortunately, the sustainable path isn’t the path web3 gaming is going down, we’re all pretending that by enticing players through endless token inflation and a quasi pyramid schemes that this is the future. It isn’t. We all know it.

My thesis that crypto gaming isn’t the future *can* be proven wrong. By building sustainable games, maybe, just maybe, web3 can bring something good to the gaming industry. But not at all in the way it is doing now. No way. Not everything has to be on-chain. 0x has an off-chain order book for its DEX, but on-chain settlement. The future will have to be a mix of centralised and decentralised. I don’t see what can be decentralised about games except maybe in-game customisations as NFTs (although this could be a more inefficient way of doing things currently, maybe it works out because *the culture*), but from a purely technical perspective having blockchains for hosting all in-game data will make games incredibly slow. Gamers hate slow stuff, just like how traders hate latency (hence off-chain order book DEXs). In conclusion, if web3 gaming continues down the path its on, it’s 100% doomed to fail. It might have a better chance by adopting a tad bit of common sense. Maybe centralised games but with governance tokens are the key to unlocking web3 gaming? I have no idea. But Play to Earn gaming definitely isn’t it.

Edit note: removed part about interoperability of game assets, too complex to explain and more of an aside. Main focus was intended to be on play to earn.

Great article, imperfectly reminds me of the Great Recession / Dave and Busters episode of IASIP https://www.youtube.com/watch?v=PS691lJzW1E

Nice article. I am bullish on Play2Earn games but nice to read another perspective.

"all these games are very underdeveloped and frankly very boring"

Overtime better and better games will be built. I remember the first mobile games being very basic and kind of lame but now mobile games are much better (and a $90B industry).

"...because their entire business model relies on them being the only supplier Robux"

Yes, they make more profit by being the only one selling Robux. Players don't benefit from this, only the business.

"It’s also against T+Cs so users can face getting banned if caught"

Yup. If I buy an NFT I own it and can do whatever I want with it. I don't want a business telling me what I can and can't do with items that I paid for.

Keep in mind majority of players don't spend money in game. Overtime if the average player can play game A and make $0 from playing and own absolutely nothing in game or play a very similar game B and make $$ from playing and actually own the items they collect in game, what option will they choose?